The transition to net zero is underway. We need to minimise our emissions to have any hopes of maintaining our 1.5°C targets. Doing so requires gargantuan effort and a lot of money. That’s where investors like us come in. However, we are inundated with different climate-related investment opportunities. So what should we focus on?

We should focus on investments which result in consequential short-term emissions reductions, for two main reasons:

-

- Immediate actions to reduce greenhouse gas emissions are:

-

- more effective in the fight against climate change, and

-

- have a stronger social impact.

-

- Immediate actions to reduce greenhouse gas emissions are:

-

- The carbon credit market underprices these projects. A future correction to this mispricing would benefit current investors.

Before getting into this, we should properly define the space.

Classifying the climate project space

Firstly, we define all climate projects as those resulting in emissions reductions. We measure greenhouse gases with kg CO2 equivalents (kg CO2e). This enables us to compare different greenhouse gases on a like-for-like basis. In this article, we often refer solely to carbon dioxide, in which case we drop the CO2e and use tonnes only.

Climate projects can take two forms:

-

- Avoidance – changing our behaviour to decrease the amount of emitted emissions. Examples include electrifying the grid, or taking actions to prevent deforestation.

-

- Removal – getting rid of carbon dioxide from the environment. This could be by carbon capture or by planting trees and enhancing natural carbon sinks.

And we view them on two different time horizons:

-

- Immediate – leads to a GHG reduction within 3 years of project start

-

- Long term – takes ~10 years to make significant reductions in GHGs

So why do we prefer immediate climate projects?

Right here, right now: the environmental and social impacts of immediacy

A tonne removed today is better than a tonne removed tomorrow

Greenhouse gas emissions are not fungible. A tonne CO2e emitted today will have a different climate impact to a tonne CO2e emitted a few years from now.

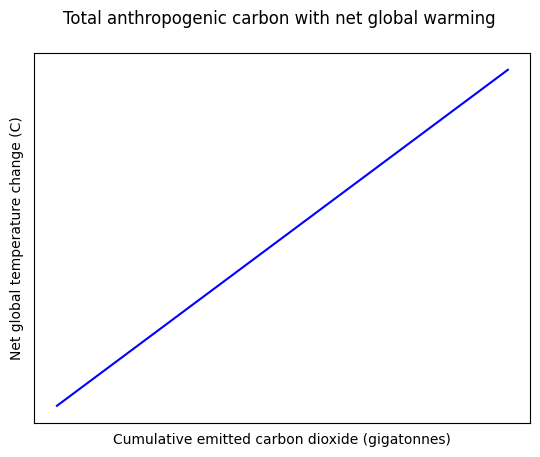

There is an almost linear relationship between the total CO2 released by humans and net global warming. In other words, for every tonne CO2e emitted, the planet gets hotter. Each tonne CO2e has the same direct impact. But this doesn’t account for feedback loops.

As the planet warms, a few things happen. Firstly (and obviously), everything gets hotter. The oceans get hotter, and so sea-levels rise due to the thermal expansion of the water. The hotter oceans evaporate more, and so there is more water vapour in the air. But water vapour is also a greenhouse gas, so we introduce another source of heating. Away from the oceans: Glaciers retreat, mountains lose snow and the icecaps melt. Ice is great at reflecting sunlight, which keeps the planet cool. As we have less ice, the planet reflects less sunlight, and so we absorb more. This introduces another source of heating. Even worse, as the permafrost melts, we begin to release tonnes of trapped methane into the air. Methane is a far more potent GHG than CO2 or water vapour, and so we introduce yet another source of heating.

And these new sources of heating lead to more water vapour, less ice and more released methane. And so on. These knock-on effects of greenhouse gas emissions are what we need to avoid.

Reducing GHG emissions now decreases today’s heating, which means less time for these feedback loops to kick in. Avoiding feedback loops is a strong reason to prefer immediate projects over longer term, but there is another equally convincing climate argument.

The journey to net-zero matters as much as the destination

As a concept, net-zero is now accepted. To keep global warming within 1.5°C targets, we must reduce our net CO2e emissions to zero before 2050. An often missed nuance is that how we decrease our emissions matters.

As mentioned earlier, there is a linear(ish) relationship between CO2 emitted and net warming. If we plot that on a graph, we see:

Today we’re at around 1.1°C of net heating. If we extrapolate that line to 1.5°C on the vertical axis, we end up with this:

And so, the point on the x-axis corresponding to 1.5°C on the y-axis (green lines) is the maximum amount of emitted CO2e. To stay in line with the Paris targets, we cannot exceed this amount. The difference between the green and the red (today) is our remaining carbon budget. For us to stay within our targets, we need to get to net-zero by 2050, without exceeding this carbon budget.

This impacts how our emissions must change. For example, maintaining global emissions as they are in the short term and then reducing them to zero in the 2040’s would not work. We would exceed our carbon budget, despite reaching net-zero emissions in 2050.

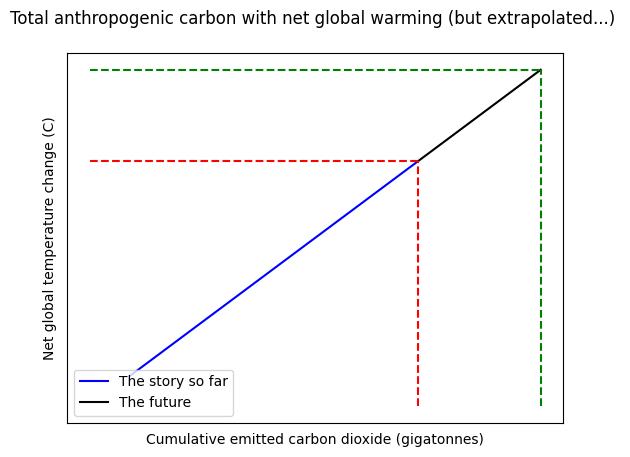

This leads to the IPCC net-zero pathways. These suggested reduction pathways give us a safe way to net-zero. The recommendation is a decrease of emissions to c50% of 2010 levels by 2030, and then a final reduction till net-zero by 2050. A few of the suggested pathways which would limit emissions to 1.5°C (from differing model regimes) are below:

All the IPCC scenarios above ensure we stay within our carbon budget. By focusing on immediate reduction, we work within the IPCC pathway and derisk the journey to net-zero.

The social cost of carbon will keep increasing: we should move now before it’s too late

How much does a tonne of carbon dioxide emissions cost? According to the carbon markets, a fair trade carbon credit is around €10 per tonne. However, policy makers and economists use an alternative pricing framework: carbon value. To quote the UK Government:

GHG emissions values (“carbon values”) are used across government for valuing impacts on GHG emissions resulting from policy interventions. They represent a monetary value that society places on one tonne of carbon dioxide equivalent (£/tCO2e). They differ from carbon prices, which represent the observed price of carbon in a relevant market (such as the UK Emissions Trading Scheme).

This cost is also known as the marginal abatement cost (MAC). The MAC (and equivalents) allow government to attribute a £-value to policy affecting emissions.

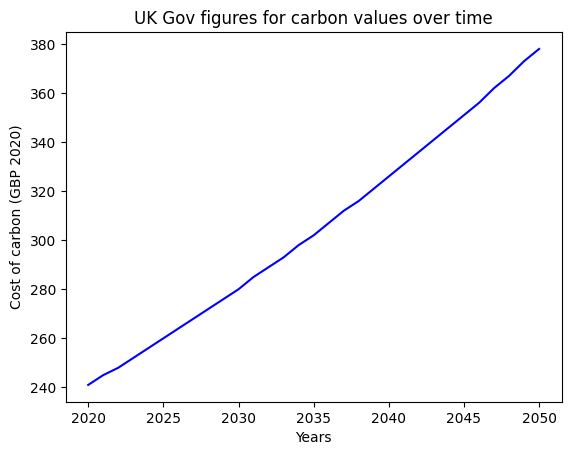

The UK Government forecasts marginal abatement costs to increase over time as follows:

But what does this mean for us? Today, the MAC is £251 per tonne CO2e. The MAC forms part of the calculations for understanding climate benefit in policy. For example, a policy change leading to a removal of 1 megatonne of CO2e would lead to a benefit of £251m. This climate benefit is a component of a broader cost-benefit analysis. As the MAC increases, radical policy measures become more and more palatable, as the outcomes of the cost-benefit analysis change.

In fact, the Trump administration did this to impact the Obama administration’s environmental pledges. The Trump administration issued a new social cost of carbon (SCC, analogous to the MAC) to replace Obama’s. Trump’s was an order of magnitude lower than Obama’s ($4 per tonne as opposed to $43 per tonne). This allowed the Trump administration to make the economic case for the rolling back of federal environmental standards.

For us, this means two things:

-

- The social cost of carbon is increasing over time. This means the societal impact of carbon emissions will exacerbate. Removing emissions today rather than in 10 years lessens the cost on society.

-

- The increasing MAC will permit governments to justify more severe policy for the climate. (Governments having the political will for this is a separate discussion entirely!) Focusing on emissions reduction today decreases the risks of this, minimising disruption.

There are compelling environmental and social reasons to prioritise immediate actions: There is more value in removing CO2 today than in future. This “time value of carbon” is analogous to the time value of money. As investors, we can take advantage of this time value of carbon.

Inefficient carbon credit pricing: an understated economic opportunity

Many climate projects make use of carbon credits. Carbon markets price these credits, on a £-per-tonne-CO2e basis. The Gold Standard, one of the best standards and brokers for credits, has three pricing methodologies.

- Market dynamics, ultimately relying on supply and demand

- Project cost, dividing the total cost of the project by the total number of tonnes CO2e removed

- Value based, looking at the environmental and social value which a project delivers over its lifetime

However, these methodologies (the first two in particular) do not take the time value of carbon into account. Two offset projects may remove the same amount of CO2e, but if they have different rates of removal, then they will have different climate impacts.

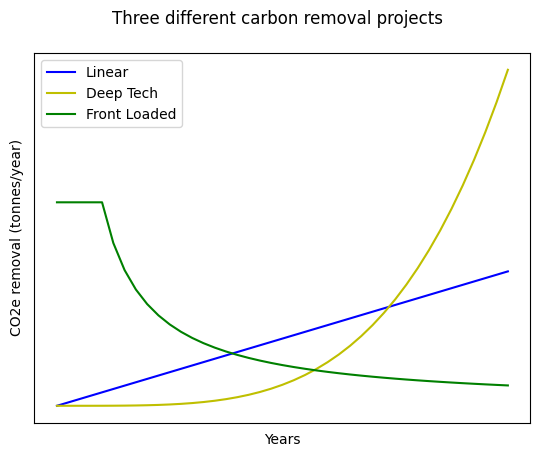

Looking at the above graph, we have three hypothetical carbon projects corresponding to three common project archetypes, for example:

-

- The green curve corresponds to the removal profile of heavily retrofitting an energy-intensive portfolio and then optimising it over time.

-

- The blue curve corresponds to the removal profile of planting a tree and other types of nature sequestration.

-

- The yellow curve corresponds to a longer term project, which is not operational for several years (R&D-heavy sequestering).

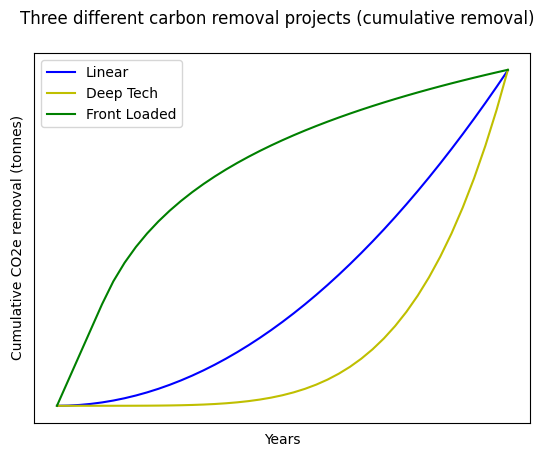

If we look at the cumulative emissions reductions for all three projects, we see the following:

All three projects remove the same amount of emissions over the project timespan, but they have hugely different removal rates. The deep tech and the linear project both are stagnant for the first few years, whereas the front loaded project has done the majority of its removal in the first few years.

With Gold Standard’s first two pricing methodologies (market dynamics and project costs), these projects could have similarly priced carbon credits. In our opinion, this is a market inefficiency. Today, the green project has the most climate impact potential. Recent controversy in the voluntary carbon markets may lead to a shift in methodologies: We are already seeing a shift from avoidance-based projects to removal-based projects. If this shift continues, we think there is an opportunity for a change in the market pricing mechanisms. With this in mind, the carbon credits from these immediate carbon projects are undervalued, and this presents an economic opportunity for investors. Investments in immediate projects with megatonne removal capabilities would benefit from an amended pricing mechanism.

Takeaways for investors: what am I looking at?

We should focus on investment opportunities which lead to immediate reductions in greenhouse gases that can move the needle. At PT1, we invest in solutions that affect the built environment: homes, offices, other buildings and infrastructure. The retrofitting of existing buildings is one area which fits those two points. This is best seen in our portfolio companies ecoworks and 42Watt, both working to retrofit residential properties, at scale. We’ve also seen this in Norway, with our recent investment in Proptly, who are building the middleware software layer for retrofit companies to scale their contractor bases nationwide.

There are interesting opportunities in the UK as well, and these are taking different forms and sitting in different parts of the value chain. Three common areas where we have seen startups are:

-

- Building optimisation platforms: tools like Demand Logic and Novacene, helping their clients save thousands of tonnes of CO2e per year by providing better control of existing commercial buildings

-

- Retrofit providers and coordinators: solutions like Hestia, FurbNow and Skoon, who are providing a one-stop residential retrofit solution for institutional housing providers and home-owners

-

- Alternative material providers: companies like Kenoteq or Seratech, researching and creating green alternatives to bricks, concrete and more

There are also providers outside of the value chain including Greenworkx, who are working to recruit and train the next generation of retrofit coordinators the UK desperately requires to hit the net-zero targets.

Companies in these spaces fit our two criteria and are exciting to us as investors.

If you’re interested in these sectors or have any comments, please get in touch at burhan@pt1-x4esqo78i0.live-website.com.

Post script: what about carbon capture?

Carbon capture is something we’ve refrained from mentioning in this article. Carbon capture is an essential part of meeting our 1.5°C targets, and carbon capture can even be seen in the pathway graph, helping us get negative emissions post 2050. However, carbon capture is a complex technology and requires time to get to megatonne or even gigatonne capabilities. Carbon capture is a slow burner, and its immediate contribution to fighting climate change will be small.

But we believe in the importance of the sector and have accordingly invested in NeoCarbon, a potential market leader in highly efficient direct air capture. Feel free to get in touch if you operate in this space as well.