How AI Is Supercharging Productivity in the Built World

Artificial intelligence is transforming the built environment at an unprecedented pace. What was once dismissed as hype is now delivering measurable productivity gains across property management, transactions, construction, and asset optimisation. This report examines how AI is reshaping real estate operations, presents a market map of key players, and offers tangible productivity metrics that investors and operators can use to evaluate opportunities.

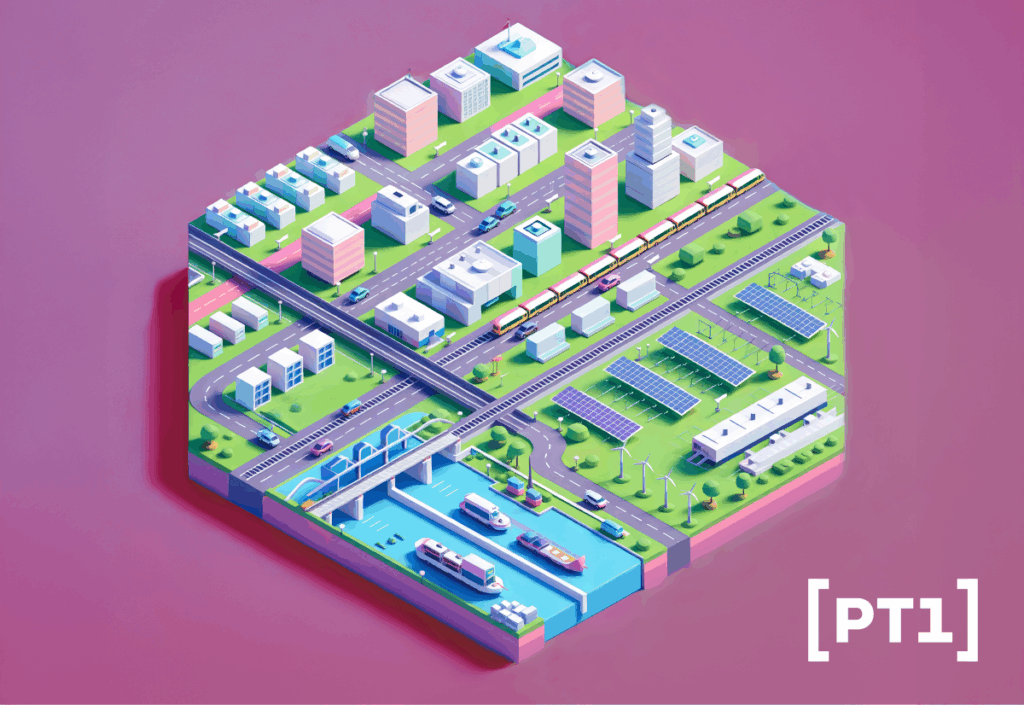

Europe’s InfraTech Moment

Europe faces a €6 trillion infrastructure transformation over the next decade—the largest since post-war reconstruction. The convergence of aging infrastructure, €2+ trillion in committed public funding, and mature AI/robotics technology creates an unprecedented opportunity for InfraTech companies to emerge as the next generation of industrial champions. Private capital is already flowing, with companies like Hometree and Terra One proving that venture-backed startups can build and scale essential infrastructure. With its unique LP base of European industrial leaders and deep infrastructure expertise, PT1 is positioned to back the bold founders who will define this new era.

Finnish multibusiness family corporation Helkama invests in European VC fund PT1 to strengthen its commitment to innovation and sustainable development

Helkama-Kiinteistöt, the real estate division of Helkama, a Finnish multibusiness family corporation with over 100 years of history in business operations, becomes one of the latest limited partners of PT1, a European VC fund investing in transformative technologies that make a tangible impact in energy, real estate, construction and climate adaptation.

Positionspapier: 5 for ‘25 – Grundlagen & Maßnahmen zur Sicherung der innovativen Wirtschaft in Deutschland

Deutschland steht zwangsläufig vor grundlegenden Transformationsprozessen: Fortschreitender Klimawandel, die notwendige Energiewende, geopolitische Risiken, der demographische Wandel und das schleichende Erodieren der globalen Wettbewerbsfähigkeit bei gleichzeitig knappen Staatskassen erfordern beherztes Handeln im Schulterschluss privater und staatlicher Kräfte. Nur so kann die Wirtschaftskraft Deutschlands und damit auch die Basis unseres gesellschaftlichen Wohlstandes und Friedens in den kommenden Dekaden erhalten bleiben oder ausgebaut werden.

Terra One receives EUR 7 million in seed funding for AI-optimised battery storage

Berlin-based technology company Terra One, a pioneer in the field of grid-connected large-scale battery storage in Europe, has received EUR 7 million in seed funding from a renowned consortium of investors. The financing round is led by PT1, the early-stage VC for real asset technologies, with the support of neosfer, the early-stage investor of Commerzbank. In addition, 468 Capital, the DeepTech investor of former Rocket Internet CEO Alexander Kudlich, N26 co-founder Maximilian Tayenthal, serial entrepreneur Jan Beckers and the scout funds of Andreessen Horowitz and Hedosophia also participated in the financing round.

Season 1 of the #Futurebuilders Podcast

Click here to listen to all nine episodes of the first season of the #Futurebuilders podcast

BESIX Group becomes new fund investor in PT1 – PropTech1 Ventures, the European venture capital platform for transformative real estate technologies

PT1 welcomes another large investor, the construction group BESIX. Founded over a century ago in Belgium, BESIX Group has become an internationally active multidisciplinary company with a leading position in construction, property development and concessions, with a yearly turnover of 3.4 billion euros (2022).

Sally Jones, former Head of Strategy, Digital & Technology at British Land, becomes first British Venture Partner at PT1 – Proptech1 Ventures, expanding the UK presence of the VC platform for transformative real estate technologies

Only two years after PT1 – PropTech1 Ventures has made its first investment in the UK, it has substantially increased its British presence. The independent venture capital platform for transformative real estate technologies has now won its first prominent UK Venture Partner, Sally Jones.

PT1 – PropTech1 Ventures launches operations of second fund vintage for transformative real estate technologies with first three startup investments

After PT1 – PropTech1 Ventures successfully completed the first closing of its second fund at 44 million euros this January, the independent venture capital platform for transformative real estate technologies has now started operations by making its first three investments in the startups Voltfang, Ontik and Climate X.

WHITEPAPER: The Future of Work and its Impact on Real Estate by PT1 and PwC

If there is one good thing to say about COVID-19 is that it has had a catalytic effect on the acceptance of a new kind of work, having forced a flexible working era upon many sectors and companies. The persistent reservations against WFH – work from home – were simply wiped away by plain necessity. And many employees have gotten used to this new paradigm.