Solving the bottle neck of labour shortage

The housing industry is in a tough spot right now because of several problems. Some of the main issues are broken supply chains, rising costs and a shortage of labour. Factors such as global climate change, worldwide conflicts and the aftermath of the COVID-19 pandemic are exacerbating the situation.

Transforming real estate assets into energy assets: A paradigm shift towards an iterated asset class

There is a big opportunity to turn traditional real estate assets into energy assets. Assets will play a crucial role in updating the energy infrastructure as the current one is developed for centralised energy generation. More and more Start-Ups are developing new value propositions along this value chain; fueled by economic incentives and heavy regulatory tailwinds.

The time value of carbon on our investment decision making

The transition to net zero is underway. We need to minimise our emissions to have any hopes of maintaining our 1.5°C targets. Doing so requires gargantuan effort and a lot of money. That’s where investors like us come in. However, we are inundated with different climate-related investment opportunities. So what should we focus on? We […]

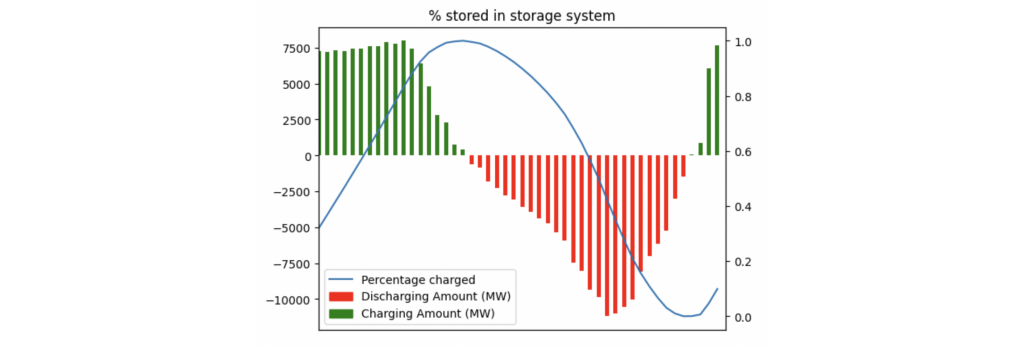

What would a perfect energy storage system in the UK look like?

The UK’s energy grid needs help. Sometimes we generate too much renewable energy, and we have nowhere to put it, or we can’t move it to somewhere where it needs to go. This doesn’t sound like a problem, except having “extra electricity” flowing around the grid is bad.

Your home isn’t renovated in a day: Why PropTech1 invested in 42watt

One of the most hotly debated topics these days is people’s ongoing search for ways to cut their energy usage. Because for some regions and cities, gas prices have gone up by easily 100% within the year, or even just a couple of months, the increase in energy prices has become a financial threat even to the middle class.

Removing carbon dioxide from the atmosphere: Why PropTech1 invested in NeoCarbon?

The climate crisis is now a reality that is having an increasingly tangible impact, forcing consumers, politicians and businesses to reduce emissions as drastically and as quickly as possible.

WHITEPAPER: The Future of Work and its Impact on Real Estate by PT1 and PwC

If there is one good thing to say about COVID-19 is that it has had a catalytic effect on the acceptance of a new kind of work, having forced a flexible working era upon many sectors and companies. The persistent reservations against WFH – work from home – were simply wiped away by plain necessity. And many employees have gotten used to this new paradigm.

Making Residential Buy-to-Let Investments Great Again: Why PropTech1 invested in Beanstock

One of the main reasons why the real estate industry is lacking behind in terms of digitalisation is that incumbents, due to constantly rising real estate prices, used to make money in their sleep, thereby smothering any need to improve and evolve.

Investing in the Future of Climate Risk Insurance for the Built World: Why we invested in FloodFlash

The real estate ecosystem is heavily exposed to all kinds of climate change related physical risks and regulators around the globe are increasing the pressure on making these risks transparent, potentially leading to severe consequences for real estate owners in valuations and interest rates, and even creating stranded assets.

Revolutionizing skilled blue-collar construction staffing: Why PT1 invested in Kollabo

Digital solutions must be designed for the construction industry and solve an indispensable problem. Proven concepts from other industries rarely work in the construction industry. Retrofitting the building stock is the most important lever for achieving the German government’s climate targets for the real estate industry. Current methods and means are not sufficient to achieve this goal in a timely manner.